Leverage Points and the Iceberg Model in Economic Development

“Folks who do systems analysis have a great belief in “leverage points.” These are places within a complex system (a corporation, an economy, a living body, a city, an ecosystem) where a small shift in one thing can produce big changes in everything.” – Donella Meadows

Following the publication of Profit For Life (2006) and Companies That Mimic Life (2016), former Board member Jay Bragdon’s latest work explores the growing realization that economies are sub-systems of life, rather than super-systems that are apart from and above life.

“When we approach economies as sub-systems of Nature, for example, we place a higher value on living assets (people and Nature) than on non-living capital assets. That’s because people and Nature are the source of capital assets and indeed all value creation.”

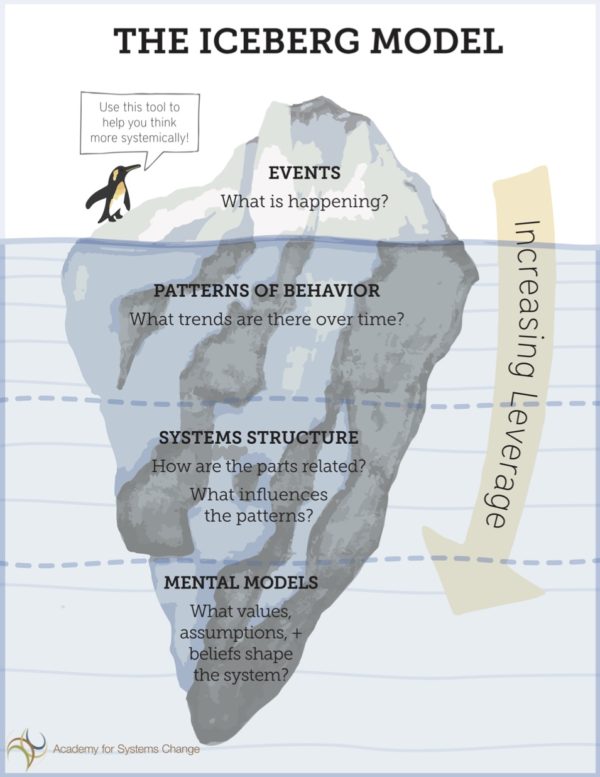

Jay’s book is grounded in the work of Systems Thinker Donella Meadows who introduced her renowned Iceberg diagram to demonstrate the power of core assumptions. Jay uses the Iceberg in his book as a visual metaphor to draw attention to the reality that the 10% we see above the water (economic results) is in fact supported by a much larger mass of thoughtful activity below the surface. As shown in this diagram, this large below-water metaphoric mass consists of: the beliefs (mental models, assumptions) we use in defining our economies; the visions and values we hold as we forge a path to the future; the organizational structures that emerge from these aspirations (which determine how effectively information flows); and the life-mimicking behaviors that ultimately determine economic results.

In political-economies, the substance of that larger mass (beneath the tip of the iceberg) is defined by the assumptions we hold: because these determine, the things we value, our goals, our thinking processes and ultimately behaviors. All of which embody strategic leverage points. Jay argues that placing a higher value on living assets (people and Nature) than on non-living capital assets is a key leverage point, enabling us to see why economies that mimic life enjoy a win-win spiral of systemic health and prosperity.

“When our mental models and governance practices shift from the ego-centric paradigm that our economies are super-systems that transcend life to the eco-centric paradigm that our economies are sub-systems of life, we create new, more robust pathways to the future. Considered as such, when economies operate as subsystems of life, they benefit from a cascade of leverage points. The measurable results we get from this are technologies that continually refresh the resources we need to survive and thrive (renewable energy, bio-innovation) plus a sustainable prosperity that requires little debt to maintain. Compared to the older industrial model of capitalism, which is drowning in its carbon emissions, waste and debt, it is the clear, pragmatic way forward.”